VWAP Strategy V1

A selective mean-reversion framework designed to capture post-selloff flushes that revert back to VWAP (fair value). Built to stay highly selective — few trades, high R-multiple potential.

What it does

- Targets volatility flushes that often revert toward VWAP (fair value).

- Trades the reaction after forced selling — not the initial drop.

- Requires both volatility regime + VWAP dislocation + exhaustion confirmation.

- Uses a 3-target structure with runner management for large R moves.

What it is not

- Not a “buy the dip” strategy during the selloff.

- Not a high-frequency / overtrading approach.

- No prediction — only reaction to confirmed exhaustion.

- No guarantee of performance; designed for testing and iteration.

Best use cases

- High-volatility environments with strong intraday ranges

- Index CFDs (NAS100 / US30) with clean VWAP behavior

- Setups designed for 3R–10R+ potential

- As a baseline rulebook for backtesting + future refinements

How it works

The VWAP Reversal Strategy looks for extreme downside dislocations below VWAP that occur during a volatility event. A trade is only allowed when the market shows acceptance below VWAP and then prints a simple exhaustion / absorption confirmation candle. The goal is to capture the mean-reversion move back to VWAP and potentially beyond.

Definitions

| Term | Meaning |

|---|---|

| VWAP | Session VWAP calculated with a reliable reset (Daily by default). |

| Deviation (Dev) | Standard deviation of (price − VWAP) over a configurable lookback; used to measure dislocation. |

| Z-Score | (price − VWAP) / Dev. Negative values = below VWAP. |

| Volatility Event | A regime filter: either an unusually large daily range or an unusually large 30-minute candle range. |

| Acceptance below VWAP | At least N consecutive closes below VWAP (not a single wick). |

| Exhaustion / Absorption | Evidence that downward pressure is weakening before entry. |

Market & Timeframe

- Instruments: NAS100 and US30 (treated identically in this version).

- Primary timeframe: 30-minute chart (initial version).

- Trading style: mean-reversion after volatility flush; intentionally selective.

- Date (rulebook draft): 27 Dec 2025.

Setup Conditions (Trade Allowed)

A trade is allowed only if ALL blocks below are satisfied:

Volatility Event (required)

At least one of the following must be true:

DailyRange >= DailyATR_Mult × ATR_Daily(14)30mRange >= BarATR_Mult × ATR_30m(14)

VWAP Dislocation (required)

- Close is below VWAP.

Z-Score <= -Z_Threshold(e.g., -2.0).- Acceptance below VWAP: at least N consecutive closes below VWAP.

Exhaustion / Absorption (required)

At least one exhaustion sign must be present. Baseline (simple + robust):

- A bullish 30-minute candle closes green AND does not make a lower low than the prior bar

(Low >= Low[1]).

Optional enhancements (later): wick/volume absorption filters.

Entry Rules

Long Entry (only):

Enter long at the close of the first qualifying bullish 30-minute candle that occurs while the setup conditions remain valid.

Risk Management & Stop Loss

Stop option A (preferred): Session-Low stop

- Track the current day/session low (reset daily).

Stop = SessionLow − Buffer × ATR_30m

This defines a clean invalidation point: if the low breaks, the flush likely continues.

Stop option B: ATR stop

Stop = EntryPrice − ATR_Stop_Mult × ATR_30m- Use if session-low is unreliable on certain CFDs or sessions.

Profit Taking & Trade Management

Three-target structure (recommended)

- TP1 (risk off):

+1RORVWAP − 0.5 × Dev. Close 30%–40%. - TP2 (fair value): VWAP touch. Close 30%–40%. Move stop to breakeven.

- TP3 (runner):

VWAP + TP3_Dev × Dev(e.g., +0.75 to +1.0). Let it run with trailing stop.

Trailing for the runner

After price reclaims VWAP (or after TP2), trail the stop using recent swing lows:

TrailStop = LowestLow(trailLen) − TrailBuffer × ATR_30m

Filters (to keep trade count low)

- Time filter (optional): trade only during selected sessions (e.g., US cash hours).

- No trade if price already reclaimed VWAP before the reversal candle appears.

- Optional: Friday late-session filter to reduce weekend gap risk.

Recommended Starting Parameters (30m)

| Parameter | Start Value / Notes |

|---|---|

| VWAP reset | Daily |

| ATR_30m length | 14 |

| Daily ATR length | 14 |

| DailyATR_Mult | 1.8 |

| BarATR_Mult | 2.0 |

| Dev lookback length | 50 (start range 30–100) |

| Z_Threshold | 2.0 |

| Acceptance bars below VWAP | 2 |

| SessionLow buffer (ATR) | 0.2–0.3 |

| ATR_Stop_Mult (if used) | 1.2–1.5 |

| TP3_Dev | 0.75–1.0 |

| Trail length | 6–10 bars |

| Trail buffer (ATR) | 0.2 |

Implementation Notes

- This document defines the first ruleset version for TradingView backtesting.

- Next iterations can add: wick/volume absorption filters, 15-minute entry refinement, and multi-day (swing) mode.

- Keep NAS100 and US30 identical initially; later you may tune thresholds per index if needed.

Chart visualization

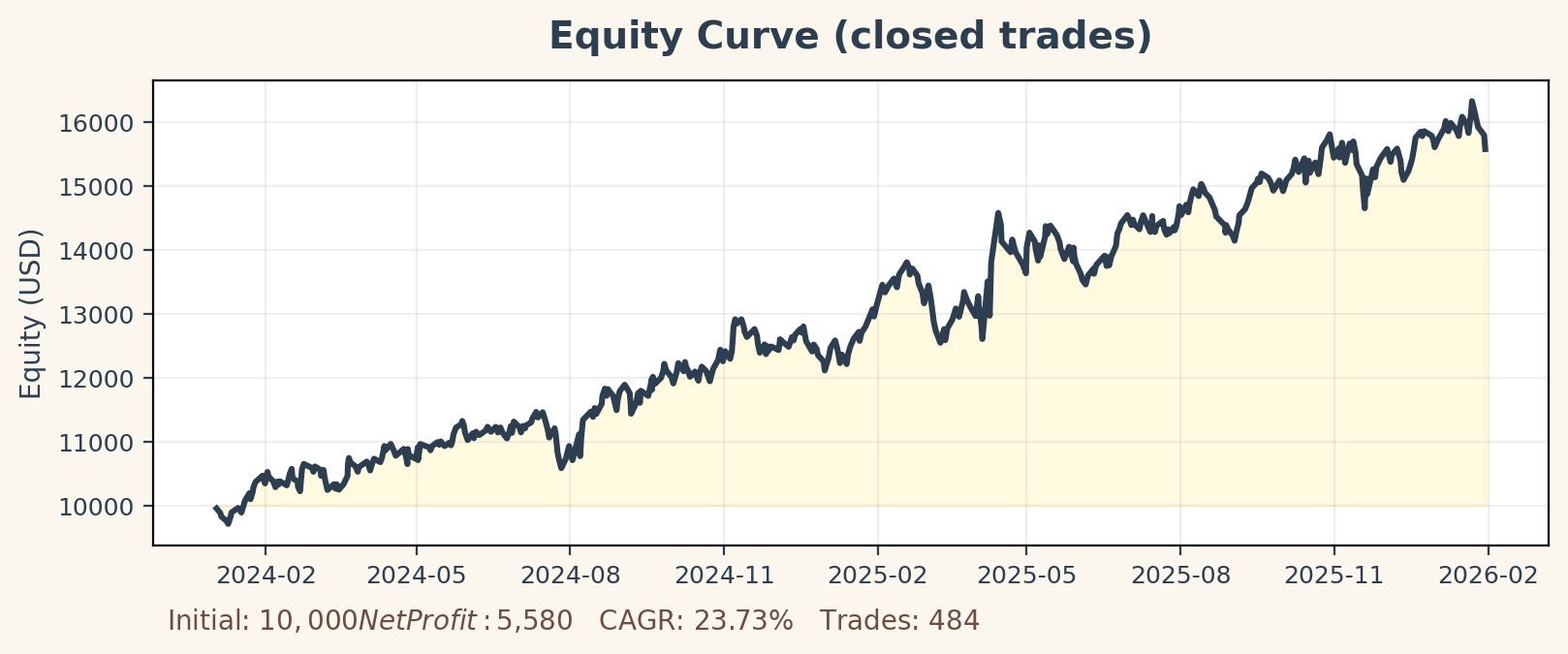

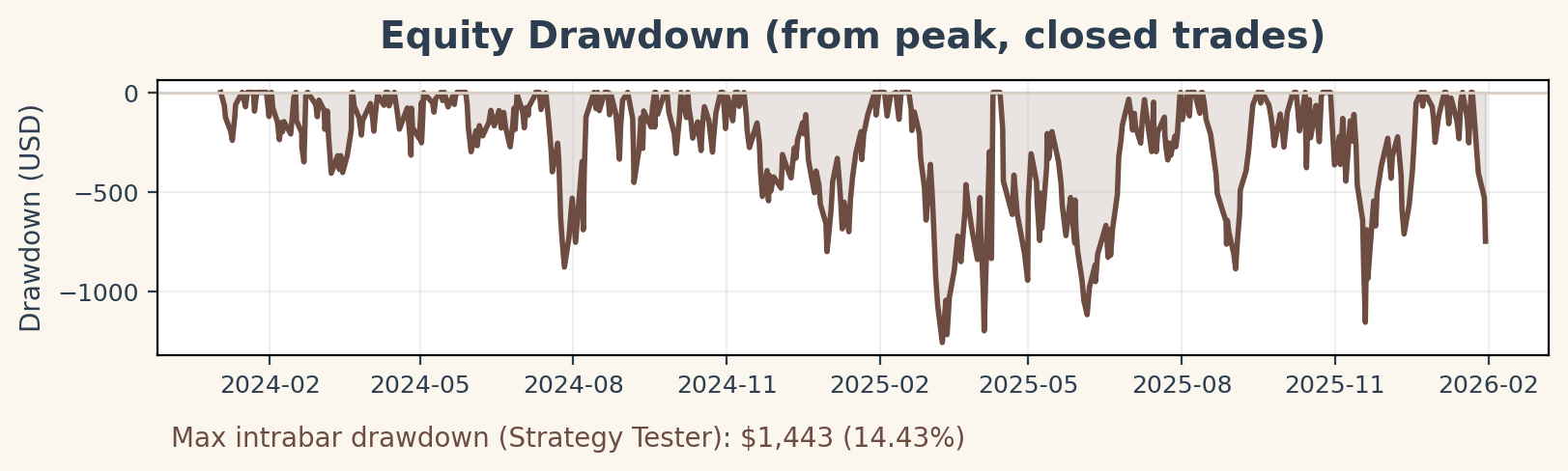

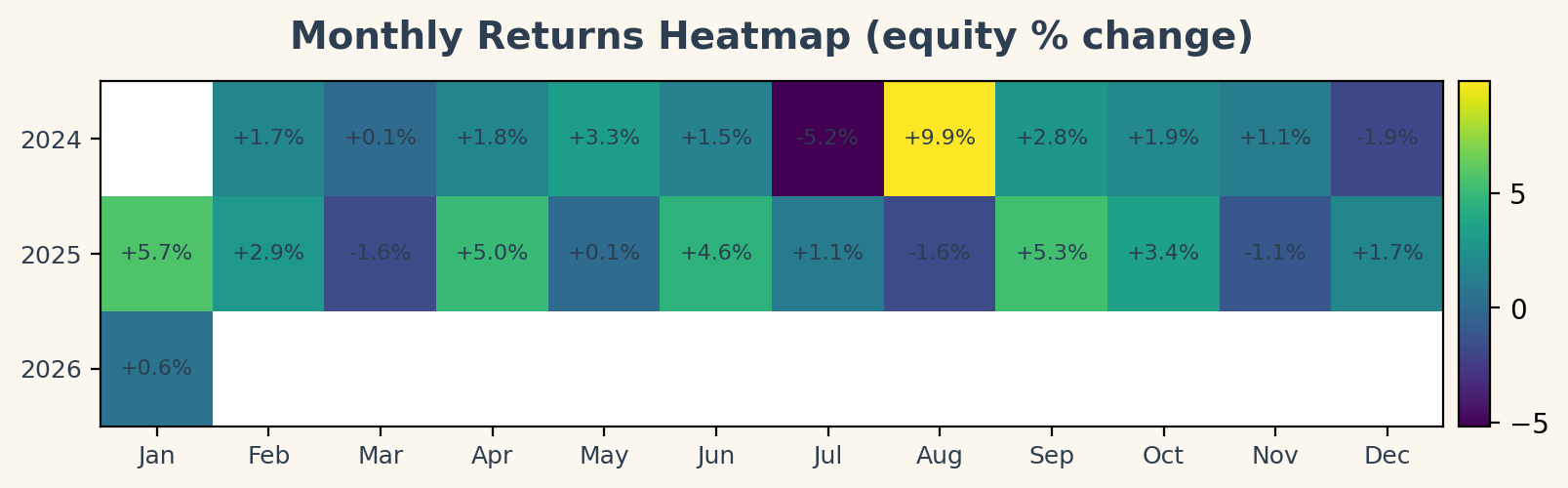

Backtest highlights

Key performance metrics and visuals from the TradingView Strategy Tester export (Pepperstone NAS100 CFD, 30-minute chart).

Equity curve

Drawdown

Monthly returns heatmap

Version Notes

- Volatility event filter + VWAP dislocation + acceptance + exhaustion confirmation

- Long-only reversal logic (reaction, not the initial drop)

- Session-low stop (preferred) or ATR stop alternative

- 3-target management with runner trailing concept